How to Minimize Risks in Solana DeFi

Decentralized finance (DeFi) on the Solana blockchain has surged in popularity thanks to ultra-low fees, lightning-fast transaction speeds, and a thriving ecosystem of decentralized applications (dApps). From lending protocols to automated market makers (AMMs), Solana offers fertile ground for innovation. But with opportunity comes risk. Hacks, liquidity shocks, and protocol failures can erase capital overnight. If you’re exploring DeFi on Solana, it’s essential to understand how to protect yourself.

This guide breaks down the key risks in the Solana ecosystem and provides actionable strategies for minimizing exposure while still benefiting from DeFi opportunities.

Table of Contents

Understanding the Risk Landscape

1. Smart Contract Vulnerabilities

At the core of every DeFi protocol are smart contracts—self-executing programs that define rules without human intervention. On Solana, smart contracts (known as programs) are written primarily in Rust, a memory-safe language, which offers certain advantages over Solidity. However, vulnerabilities still exist. A poorly written or unaudited contract can be exploited, as seen in several cross-chain bridge hacks that drained millions in assets.

Example: In 2022, a major exploit on a Solana bridge highlighted the risks of relying on unaudited or hastily deployed contracts. Even protocols with significant funding and users are not immune.

2. Liquidity Risks

Decentralized exchanges (DEXs) on Solana rely on liquidity pools. When liquidity providers withdraw funds en masse—perhaps due to market fear—it can leave traders exposed to slippage and impermanent loss. Thin liquidity can also amplify price volatility, especially for smaller tokens in the Solana ecosystem.

3. Network Reliability

While the Solana blockchain is renowned for its throughput (tens of thousands of transactions per second), it has faced temporary outages. These disruptions can lock users out of critical trades or prevent withdrawals at high-risk moments.

4. Governance and Centralization Concerns

Many DeFi protocols rely on decentralized governance through token voting. In practice, whales holding large amounts of governance tokens can sway decisions in ways that might not align with smaller users’ interests. On Solana, where token distribution sometimes favors insiders or early backers, this imbalance can heighten risks.

Strategies to Minimize Risk

1. Favor Audited and Battle-Tested Protocols

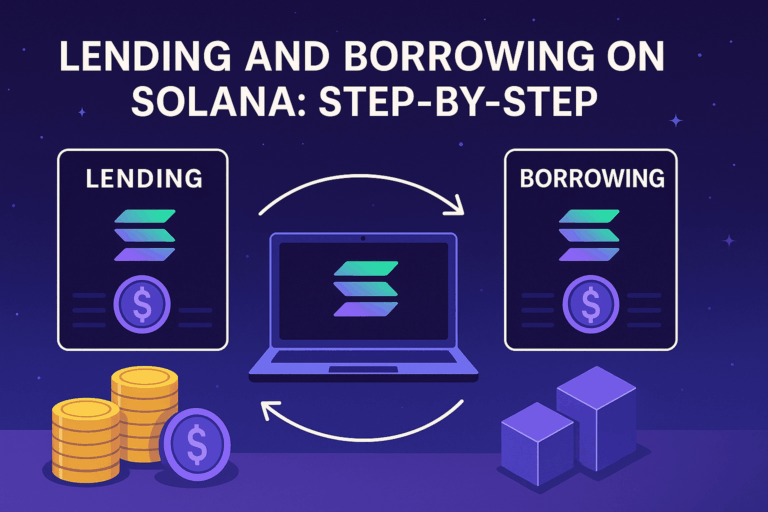

Not all dApps on Solana are created equal. Before depositing SOL or stablecoins into a protocol, check if it has undergone third-party audits. Look for projects with established reputations, transparent development teams, and open-source code. For instance, lending platforms like Solend and AMMs such as Raydium have undergone extensive scrutiny compared to experimental forks.

2. Diversify Your Exposure

Just as traditional investors diversify across stocks, DeFi participants should spread capital across multiple protocols. Instead of depositing all assets into a single yield farm, allocate smaller amounts across lending, staking, and liquidity pools. This way, a failure in one protocol won’t wipe out your portfolio.

3. Use Hardware Wallets and Trusted Interfaces

Security doesn’t end at the protocol level. Protecting private keys is critical. Hardware wallets like Ledger or Trezor integrate with Solana dApps through wallet adapters, adding a physical confirmation layer to transactions. Avoid connecting wallets to unknown front-ends or phishing sites that mimic legitimate DeFi platforms.

4. Monitor Network and Protocol Health

Staying informed is part of risk management. Solana maintains a public status dashboard to report network performance. Similarly, many protocols publish transparency dashboards showing total value locked (TVL), liquidity depth, and collateral ratios. By monitoring these metrics, users can exit positions before instability escalates.

5. Hedge Against Market Volatility

Market risk is inherent in DeFi. Stablecoins like USDC on Solana offer a way to preserve value, though even stablecoins carry risks (e.g., depegging events). Advanced users may use decentralized derivatives protocols on Solana, such as Drift or Zeta Markets, to hedge against price swings in SOL and other assets.

6. Start Small and Scale Gradually

If you’re new to Solana DeFi, treat it like learning to swim. Begin with small amounts you can afford to lose. Gain familiarity with transaction flows, gas fees (measured in fractions of a cent), and protocol mechanics before committing significant capital.

Case Study: Navigating a Liquidity Crunch

Consider a hypothetical scenario: you provide liquidity to a SOL/USDC pool on Raydium. Suddenly, SOL drops 30% in a day due to market-wide panic. As liquidity providers withdraw, the pool thins, and slippage increases. If you had placed all your funds into this single pool, you’d face impermanent loss and difficulty exiting without losses.

However, if you had split funds between Raydium, a lending protocol like Solend, and simple staking of SOL, the shock would be cushioned. Your diversified strategy keeps you liquid and less exposed to a single failure point.

Recent Developments in the Solana Ecosystem

Despite challenges, Solana continues to innovate. In 2023 and 2024, upgrades such as QUIC-based transaction handling and stake-weighted QoS have improved network reliability. Ecosystem growth has also been notable, with new decentralized apps on Solana emerging in areas like real-world asset tokenization and decentralized stablecoins. These advancements reduce some systemic risks but also attract new participants, making risk education even more critical.

Conclusion

The allure of Solana DeFi lies in speed, low fees, and cutting-edge innovation. Yet without proper risk management, even promising opportunities can turn disastrous. By choosing audited protocols, diversifying exposure, safeguarding wallets, and staying informed about network health, users can significantly reduce their vulnerability.

As with any frontier market, the Solana ecosystem rewards those who balance optimism with caution. The goal isn’t to avoid DeFi altogether, but to participate intelligently. Start small, stay informed, and think long-term.

What about you? How are you managing risks in Solana DeFi? Share your strategies and experiences with the community—knowledge shared is risk reduced.

Brilliant piece. I’ll be sharing this with my community—too many people jump into DeFi without understanding the downside.

As someone who’s been burned by unaudited protocols before, I can confirm diversification is key.

Great balance between technical detail and easy-to-understand examples. The case study on liquidity crunch really hit home.